Cardell McKinstry, CPA

Partner, Transaction Advisory Services at Aprio | Serving private equity buyers and corporate M&A groups

Who I work with

I work closely with private equity buyers and corporate M&A groups across a wide range of industries, including construction, manufacturing and distribution, financial services and telecommunications.

My specialty

I am known for my technical excellence and due diligence expertise in identifying tax exposures in companies that are being acquired. I help both buyers and sellers create tax-efficient structures and provide innovative tax solutions that help achieve business objectives. I also have significant experience with dispositions, restructuring, leveraged buyouts and recapitalizations.

Results I have delivered

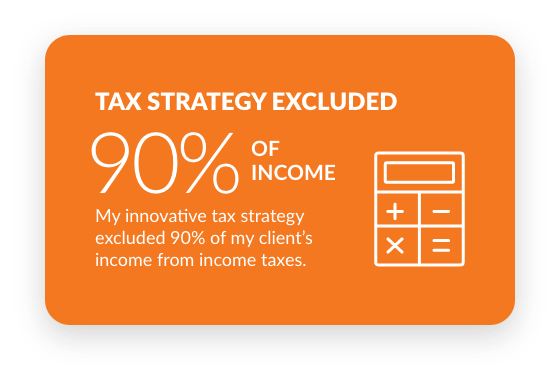

My job in any M&A deal is to maximize the value of the transaction for my client and to make sure they pay as little tax as possible within the limits of the law. I leverage my knowledge of the tax code and my 20 years of M&A experience to deliver results.

Unique things about me

I love playing online chess and reading, especially about my industry. I am also an avid college football fan and cheer for my alma mater, the University of Alabama.

When I am not at work

I enjoy being outdoors and spending time with my kids — we do a lot of puzzles and play with the family pets.

People say I am

A credible, expert problem solver who is experienced, knowledgeable, professional, organized and a good communicator.

Affiliations

I serve as Treasurer of the Association for Corporate Growth and am a former board member of Second Helpings, a charity that helps fight against food insecurity for the economically disadvantaged by partnering with various grocery stores. I earned my Bachelor of Science in Accounting and a Master of Taxation from the University of Alabama.